Turkey President Recep Tayyip Erdogan is fighting for economic wins, trying to keep his country from complete collapse in the face of its dying form of currency, the lira.

The lira has dropped nearly nine percent against both the dollar and euro in just a few short days.

UPDATE: Turkey‘s currency crisis gets worse with fresh 11% plunge

This year alone, its lost a third of its value.

Meanwhile, President Donald Trump continues to chastise the country for its refusal to release a Christian pastor held in captivity by Erdogan’s government.

From the Daily Mail:

President Recep Tayyip Erdogan is wrestling to get the Turkish economy on track after the currency hit a record low against the dollar today, amid a financial shockwave which Donald Trump worsened by promising to double tariffs on the NATO ally.

The lira lost nearly nine per cent against the dollar and euro on Friday – and has lost over a third of its value against the currencies so far this year.

Erdogan framed Turkey’s currency crisis as a ‘national battle’ against economic enemies, including the U.S., saying: ‘if they have their dollar, we have the people, we have Allah’.

He urged people to exchange gold and hard currency into lira to help stabilize the exchange rate, but Trump’s tweet that he had doubled steel and aluminium tariffs on Turkey deepened the financial crisis.

It comes amid worries about Erdogan’s influence over monetary policy and worsening U.S. relations which have snowballed into a market panic.

‘I have just authorized a doubling of Tariffs on Steel and Aluminum with respect to Turkey as their currency, the Turkish Lira, slides rapidly downward against our very strong Dollar!’ Trump said on Twitter.

‘Our relations with Turkey are not good at this time!’

Trump’s announcement came after talks in Washington this week failed to resolve the impasse which has led both sides to slap sanctions on senior officials amid fears of graver measures to come.

Earlier on Friday, President Erdogan brushed off any concerns during a speech in the northeastern city of Bayburt on Friday, saying: ‘The dollar cannot block our path. Don’t worry.

‘However, I say it once again from here. If there is anyone who has dollars or gold under their pillows, they should go exchange it for liras at our banks.

‘This is a national, domestic battle. This will be my people’s response to those who have waged an economic war against us.’

Turkey was facing artificial financial volatility, Erdogan said, and people should not pay close attention to foreign exchange prices, and should instead focus on the ‘big picture’.

However, once President Trump had tweeted about authorizing higher tariffs on imports from Turkey, President Erdogan phoned up Russian President Vladimir Putin.

Putin and Ergogan discussed economic and trade ties by phone, the Kremlin said in a statement.

The two leaders also spoke about the success of joint strategic projects between the two countries, particularly in the energy sphere, it said.

The lira hit a record low of 6.24 per dollar on Friday, before recovering to 5.92 – still down a whopping 7 per cent on the day.

The currency has fallen 66 per cent since the start of the year, pushing up the cost of goods for Turkish people and shaking international investors’ confidence in the country.

One of the triggers of the turmoil has been a standoff with the U.S. over a detained American pastor that Turkey, a NATO ally, has put on trial for espionage and terror-related charges linked to a failed coup attempt in the country two years ago.

Washington has demanded the pastor’s release and imposed financial sanctions on two Turkish ministers and warned of additional measures.

High level meetings in Washington between U.S. and Turkish officials ended this week without an apparent resolution.

Meanwhile, investors are worried about the economic policies of President Recep Tayyip Erdogan, who won a new term in office in June with sweeping new powers.

Erdogan has been putting pressure on the central bank to not raise interest rates in order to keep fueling economic growth. He claims higher rates lead to higher inflation – the opposite of what standard economic theory says.

Independent analysts argue the central bank should instead raise rates to tame inflation and support the currency.

In modern economies, central banks are meant to be independent of governments to make sure they set policies that are best for the economy, not politicians. But since adopting increased powers, Erdogan appears to have greater control over the bank as well.

Last week, he called on Turks to convert their foreign currency and gold into Turkish lira to help the currency.

Treasury and Finance Minister Berat Albayrak – who is Erdogan’s son-in-law – was scheduled later on Friday to outline a ‘new economic model.’

The currency drop is particularly painful for Turkey because the country finances a lot of its economic growth with foreign investment. As the currency drops, Turkish companies and households with debt in foreign currencies see their debts expand.

Coupled with an inflation rate of nearly 16 percent, that could cause a lot of damage to the local economy.

Foreign investors could be spooked and try to pull their money out, reinforcing the currency drop and potentially leading to financial instability.

Aylin Ertan, a 43-year-old caterer in Ankara, said she was concerned over the future of her small business.

‘The price of the food that I buy increases day by day, the fuel that I put in my car to distribute lunches is more expensive, but I cannot raise my prices from one day to the next,’ she said. ‘On some days, I end the day with a loss.’

The Truth Must be Told

Your contribution supports independent journalism

Please take a moment to consider this. Now, more than ever, people are reading Geller Report for news they won't get anywhere else. But advertising revenues have all but disappeared. Google Adsense is the online advertising monopoly and they have banned us. Social media giants like Facebook and Twitter have blocked and shadow-banned our accounts. But we won't put up a paywall. Because never has the free world needed independent journalism more.

Everyone who reads our reporting knows the Geller Report covers the news the media won't. We cannot do our ground-breaking report without your support. We must continue to report on the global jihad and the left's war on freedom. Our readers’ contributions make that possible.

Geller Report's independent, investigative journalism takes a lot of time, money and hard work to produce. But we do it because we believe our work is critical in the fight for freedom and because it is your fight, too.

Please contribute here.

or

Make a monthly commitment to support The Geller Report – choose the option that suits you best.

Quick note: We cannot do this without your support. Fact. Our work is made possible by you and only you. We receive no grants, government handouts, or major funding.Tech giants are shutting us down. You know this. Twitter, LinkedIn, Google Adsense, Pinterest permanently banned us. Facebook, Google search et al have shadow-banned, suspended and deleted us from your news feeds. They are disappearing us. But we are here.

Subscribe to Geller Report newsletter here— it’s free and it’s essential NOW when informed decision making and opinion is essential to America's survival. Share our posts on your social channels and with your email contacts. Fight the great fight.

Follow Pamela Geller on Gettr. I am there. click here.

Follow Pamela Geller on Trump's social media platform, Truth Social. It's open and free.

Remember, YOU make the work possible. If you can, please contribute to Geller Report.

Join The Conversation. Leave a Comment.

We have no tolerance for comments containing violence, racism, profanity, vulgarity, doxing, or discourteous behavior. If a comment is spammy or unhelpful, click the - symbol under the comment to let us know. Thank you for partnering with us to maintain fruitful conversation.

If you would like to join the conversation, but don't have an account, you can sign up for one right here.

If you are having problems leaving a comment, it's likely because you are using an ad blocker, something that break ads, of course, but also breaks the comments section of our site. If you are using an ad blocker, and would like to share your thoughts, please disable your ad blocker. We look forward to seeing your comments below.

I would, as would most civilized people, take Trump over Allah. The latter is no more than a proponent of hatred, rape, mass-murder of infidels, anti-Semitism, bigotry and every depravity practiced by Muslims. Erdogan is Islam’s Hitler; one can only pray he comes to the same pathetic and deserving end.

One can oppose Trump and not take Allah. Why is it Trump’s business what goes on with someone who has lived in Turkey since the 1990s?

He is an American citizen. That’s what his business is with this man.

you are replying to a jihadi supporter or a jihadi

He is not in the USA though.

Are you serious? Just because a U.S. citizen is not on U.S. soil, does not mean he, or she is not a concern of the president. If Trump wanted to play like Erdogan, he would have sent a couple of SEAL team’s over to Turkey and cleaned the clocks of more than a few filthy Turks and brought that pastor home and shared the photos of the operation with Erdogan later via FB.

If Trump did that, that would be an international incident and almost certainly mean the end of the US military at Incirlik.

Its not an “international incident” already, by them taking and holding a foreign citizen for no reason. Get with it.

No because there is a reason—advocating overthrow.

Who is “advocating overthrow?”

As time goes by most people get smarter . . . you don’t, why is that?

What qualifications do you have to judge?

It’s not too late for that is it???

Are you serious? Just because a U.S. citizen is not on U.S. soil, does not mean he, or she is not a concern of the president. If Trump wanted to play like Erdogan, he would have sent a couple of SEAL team’s over to Turkey and cleaned the clocks of more than a few filthy Turks and brought that pastor home and shared the photos of the operation with Erdogan later via FB.

Pastor Andrew Brunson is an American Pastor who has been ministering the Good News about Jesus to the people of Turkey for well over 20 years. He is being kept as a political prisoner because he is falsely accused of involvement in the coup attempt, be it fake or real, against Erdogan. This is BS, but Erdogan did this to try to force the US into extraditing an Islamic friend of the Clintons named Gulen, who is accused of fomenting the coup, and who has made a killing in the US receiving taxpayer dollars for his large number of Islamic schools. I am in favor of sending Gulen to Turkey, but he is favored by the globalist scum.

Pastor Andrew Brunson is an American Pastor who has been ministering the Good News about Jesus to the people of Turkey for well over 20 years. He is being kept as a political prisoner because he is falsely accused of involvement in the coup attempt, be it fake or real, against Erdogan. This is BS, but Erdogan did this to try to force the US into extraditing an Islamic friend of the Clintons named Gulen, who is accused of fomenting the coup, and who has made a killing in the US receiving taxpayer dollars for his large number of Islamic schools. I am in favor of sending Gulen to Turkey, but he is favored by the globalist scum.

Fake Allah is not their savior.

I wonder will Erdogan raise the price of keeping the invaders from crossing into the EU.

Merkel is paying Turkey to not have them cross over. Eventually both will do down.

The Lira is worth less so will money hungry Merkel have to pay more as Turkey tank$?

Germany warns Erdogan: Europe ‘will not be blackmailed’

August 3, 2016

Germany’s vice chancellor said the EU “will not be blackmailed” after Turkey threatened to walk away from its agreement to reduce the flow of migrants into Europe.

Turkish Foreign Minister Mevlut Cavusoglu said Ankara would bail on the agreement if it does not receive visa-free travel for Turks in return.

…

http://www.worldtribune.com/germany-warns-erdogan-europe-will-not-be-blackmailed/

Whether it is ‘fake allah’ or ‘real allah’ it’s still EVIL AS HELL !!

Erdogan ass is getting baked ! LOL !

Turkey govt allows organ harvest of prisoners and orphaned children killing them in the process http://tinyurl.com/mfpzzl8

And this country is NATO member ! Left/liberals are ok with organ harvesting by killing babies too !

Trump has no clue about it , just like 99% of Americans

Trump leverages economics instead of war.

Trump will win at that too!

He plays hard ball.

Be glad we don’t have Hillary.

Turkey will NEVER be allowed to revive the Ottoman Empire in any way, shape or form. They lost the war against the West in the past, and they shall do so again.

They might not lose this time. It’s pretty easy to win a war when only one side is fighting.

If we have money and Turkey only has Allah — then Turkey has nothing because Allah doesn’t exist — this non-existant ogre is just the alter-ego of Mohammed, a figment of his imagination in his purpose of duping the people and self-agrandizing himself. How can so many believe all this nonsense called islam — it is just a hoax.

If you only have ‘allah’ you have nothing. ‘allah’ is as empty as your bank accounts. ‘allah’ was the invention of a power hungry criminal. The once boastful ‘caliphate’ were always invoking ‘allah’ but ‘he’ did not do them any good.

Does this mean dried apricots will go for cheap now?

Only fruit I know that tastes better dried than fresh.

p.s. – dried tomatoes come close.

And Turkish ” Delight “??

Turkey is the enemy and has been for a long time. Great them like it.

Oh well Erdogan, better start praying to Allah to save your currency.. Oh that’s right, you can’t because Allah controls EVERYTHING AND EVERYBODY, according to Islam. So therefore it is Allah devaluing your currency, he’s just using the US to do it.. Allah mustn’t like you very much .

Look how the feckless allah has helped the Arabs defeat the Jews in the last 70 years . . . . lol

I suspect allah might been one of the 60 odd genders . . . . or a rock in Medina!

‘allah’ the IDOL of “black rock” is located in Mecca in a square black shack lying in a corner where the “faithful” can kiss it. Oh! I almost forgot. All of the other IDOLS were removed from the shack.

You have it . . . . . MooHAMed wanted to be like the Jews & Christians, and then towards the back of the book he wanted to kill them all.

He was evidently illiterate, probably thought like a Dhimmikkkrat . . . .

Erdogan will wake up when it takes a wheelbarrow full of lira to buy a loaf of bread, maybe.

He will wake up in a suite in Claridges more likely

Well they all rely on Allah’s will to decide things. Obviously the tanking of the Lira is his will.

Nope. All our fault.

Trump is more powerful than God!

Trump has common sense on his side

This scum shouldn’t even be in NATO!!! https://www.aljazeera.com/news/2018/06/turkey-receive-35-jets-opposition-senate-180621095037371.html

Erdogan is his own worst enemy

– the standard remedy for a sliding currency

– is to raise domestic interest rates

– that works, because it rewards investors who hold assets

– that are denominated in that currency

– BUT Erdogan is a devout Muslim who hates interest

– so he refuses to raise interest rates

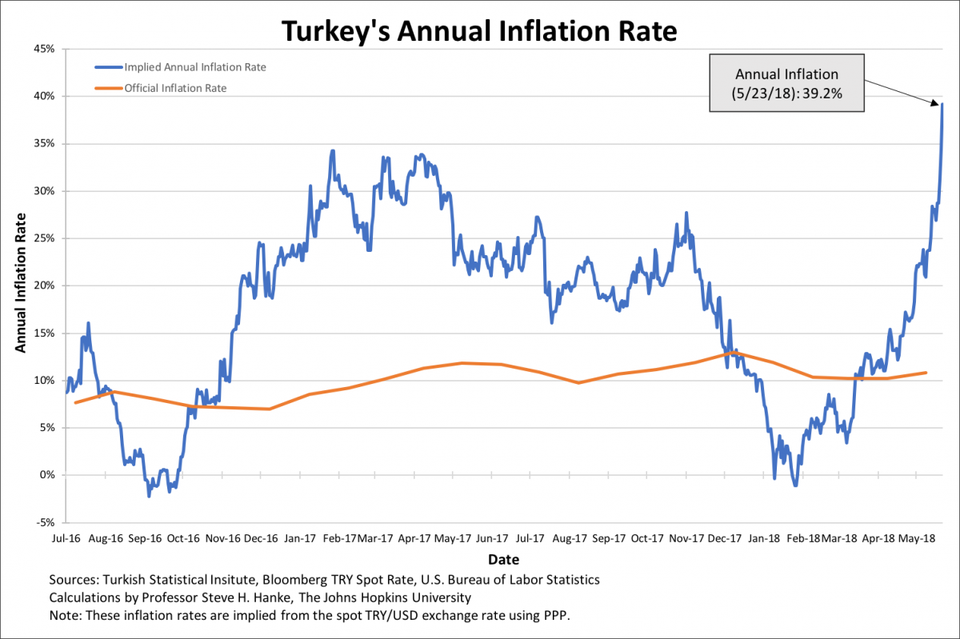

REAL inflation in Turkey

– is over 40%

– “Turkey’s rate of inflation is 3.2 times higher than the official rate – leading economist”

– https://ahvalnews2.com/turkey-economy/turkeys-rate-inflation-32-times-higher-official-rate-leading-economist

– the ‘official’ inflation rate is often bogus in 3rd world countries

– because they can’t stand the truth

– the most accurate method is to take the black market exchange rate

– and use purchasing power parity [PPP] data

– to calculate how much domestic prices actually increase